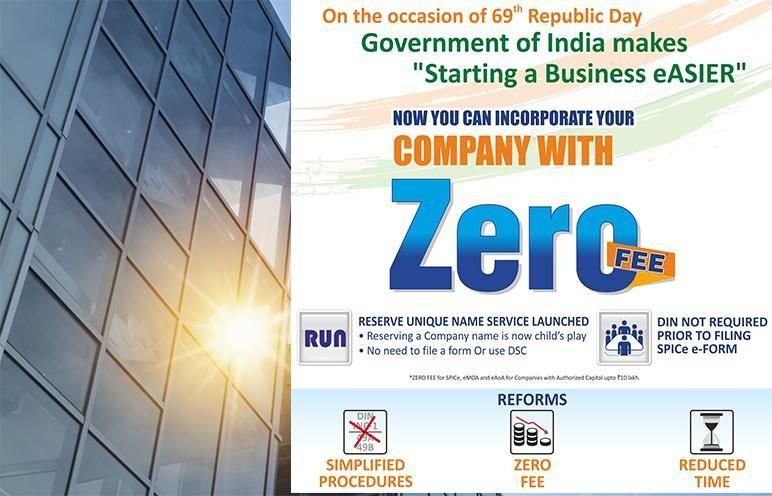

A great initiative has been taken by the government of India to remove the government fees levied on the company registration in India. Along with this benefit, certain other initiatives are taken by the government to simplify the procedure for registration of companies.

Earlier the aspiring entrepreneurs and the startups have to go through a tedious procedure for company registration and bear a substantial cost for it. Whole process starting from obtaining the director identification number to acquiring the certificate of incorporation was time-consuming and troublesome. Applying for the name and then acquiring the name approval from the ministry was a common problem that everybody was facing.

Initiatives

Considering the apprehensions of the startups and small business government has taken following significant steps to make the company registration process hassle-free and quick-

1. No government fees will be levied for all the company registrations up to an authorized capital of Rs.10 lakh.

2. A separate procedure is required to be followed for filing a company name.

3. New services known as the Reserve Unique Name (RUN) will be launched.

4. Company name approval will be filed without using digital signatures.

5. DIN will not be required to be a file for company name approval.

6. DIN will be required only while filing the SPICE forms.

Benefits for Startups and emerging entrepreneurs

These initiatives taken by the government will give a great head start to the every emerging company and promote ease of doing business in India. Further, the cost of registration of the company in India will reduce drastically as no government fees will be levied on company registration. Moreover, the simplification in procedure will also significantly reduce the time consumed in company registration process.

New cost of company registration

According to the notification released by the government, the cost of registration of companies in India will reduce drastically. The new cost for the company which a person will need to bear which are as follows:

1. Government fees nil.

2. DIN Fees of Rs.500 per Director

3. DSC Fees of Rs.600 per promoter

4. State Stamp duty which comes around between Rs.200 to Rs.10,000/- (Rs.10,00 stamp duty is for Punjab).

5. Professional fees (Comes around from Rs.4,000 to Rs.15,000/-)

6. Stamp paper and miscellaneous cost come around to Rs.500 to Rs.2000/- (Depends upon the number of members).